The rise of fictitious capital

By ‘real capital’ Marx meant money capital invested in physical means of production and the workforce itself with a view to producing commodities to be sold on a market in the expectation of realising a profit – or financial return – from selling them. However, what has become increasingly salient in recent decades is another form of capital that Marx dubbed ‘fictitious capital’.

Fictitious capital does not involve the transformation of money into commodities. It is not about investing in means of production to produce commodities for sale on a market. In this respect it is distinguishable from interest-bearing capital in the form of bank loans to businesses that produce commodities. The latter do not constitute fictitious capital as such.

Bank loans become fictitious capital when they are used for some other purpose than financing the production of commodities. For instance, you might borrow money from a bank to purchase a new car or, indeed, pay off another debt. The bank advances the loan on the understanding that it will be repaid, plus interest, over a certain period; it expects to make a ‘financial return’ no less that a factory producing widgets expects to make a financial return. Marx represented this formulaically as M-M’ where M represents the sum loaned out – the principal – and M’ represents the principal returned to the lender plus interest paid by the borrower out of her wages or savings.

In this scenario no new or additional value has been created – unlike in the case of the M-C-M’ circuit where C is capital invested in physical means of production. There has simply been a net transfer of money from the borrower to the lender. The lender has gained money at the expense of the borrower. While, for Marx, the M-C-M’ circuit quintessentially defines the capitalist mode of production, it is the M-M’ circuit, which starts and finishes with money, that most directly, or overtly, expresses what motivates capitalist production – namely, to make money. In this instance:

‘The production process appears simply as an unavoidable middle term, a necessary evil for the purpose of money-making. This explains why all nations characterised by the capitalist mode of production are periodically seized by fits of giddiness in which they try to accomplish the money making without the mediation of the production process’ (Capital, Vol. 2, Ch.1).

The desire to make money by bypassing the production process, as it were, has become increasing apparent with the growing ‘financialisation’ of the economy. What financialisation does is to drive investors to seek out and promote every conceivable kind of revenue flow – from student debt to mortgage repayments and much more besides – that can be turned into financial assets and bundled up in ways that make then appear more reliable and attractive as a source of future income.

Fictitious capital can be characterised as an outgrowth of the credit system. Traditional bank capital did indeed aid industrial production through the provision of credit to industrial enterprises as Marx noted, even if the banks themselves took a cut from the resulting increase in industrial output. With fictitious capital there is a difference. The tendency is to make money, not out of increased physical output but out of money itself in the form of various revenue streams. The financial instruments available to do this are diverse and evolving and include not just collateralised debt obligations or loans but also bonds, equity stocks and various kinds of derivatives.

If one were to identify a convenient starting point when financialisation began to seriously take off as an economic trend this would probably be the collapse of the Bretton Woods monetary system in the 1970s that had formally linked international currencies to the US dollar (itself convertible into gold up until 1971 when President Nixon abruptly abandoned convertibility). The new system of floating exchange rates paved the way to a sharp rise in currency speculation. In money value terms, the ratio of foreign exchange transactions to the global trade in commodities was 2:1 in 1973. By 2004 it had soared to 90:1 and has since grown even more, making the speculative trading of currencies the world´s biggest market (Firat Demir, ‘The Rise of Rentier Capitalism and the Financialization of Real Sectors in Developing Countries’, Review of Radical Political Economy, September 2007).

Subsequently, financialisation was boosted further by the Big Bang reforms of the late 1980s that deregulated financial markets and made London the leading financial centre in the world. In the wake of these reforms came various technological innovations which have also contributed to the astonishing growth in financial capital. The introduction of computers has given rise to the phenomenon of high frequency trading (HFT) employing digital algorithms to buy and sell financial assets by predicting short-term price movements in shares and identifying potentially lucrative arbitrage opportunities.

Since then, financialisation has, as it were, spilled over and penetrated even what is loosely called the ‘real economy’. Everyone is seemingly getting in on the act – from large retail establishments to manufacturing giants. Financial speculation and the provision of in-house credit are just more arrows to put in their quiver, so to speak – an additional means of making more money in an increasingly competitive world. That has made for a huge expansion in the role that financial intermediaries play within the economy and a notable diversification of the kinds of financial instruments at their disposal. Indeed, this has advanced to such an extent that, according to Ravi Bhandari, there is ‘no longer a purely financial sector (banks, insurance companies, etc.) on the one hand, and a ‘productive’ sector on the other’ (tinyurl.com/3d254kmy).

The stock market has been dubbed a market par excellence for fictitious capital, representing the capitalisation of property rights (as opposed to the capitalisation of production itself in the case of real capital) and, as such, constitutes a market for the circulation of these property rights. These rights, suggested Marx, represent ‘accumulated claims, legal titles, to future production’ and any income resulting from that production:

‘Gains and loss through fluctuations in the price of these titles of ownership… become, by their very nature, more and more a matter of gamble, which appears to take the place of labour as the original method of acquiring capital wealth’ (Capital, Vol.3, Ch.30).

A corporation might well raise funds for investment (real capital) by issuing shares on the stock exchange. By purchasing a share, one then has a claim on the future earnings of this corporation. However, this share does not function as real capital. As Marx explained, the money advanced by investors for the purpose of being used as real capital does not exist twice, ‘once as the capital-value of titles of ownership (stocks) on the one hand and on the other hand as the actual capital invested, or to be invested, in those enterprises’. Real capital ‘exists only in the latter form’ and a share represents merely a ‘title of ownership to a corresponding portion of the surplus-value to be realised by it’ (Capital, Vol 3, Ch 29).

The shareholders will hope that, in addition to receiving dividends, the value of their shares will appreciate over time, enabling them to realise a capital gain if and when the shares are sold on the stock market (in the case of a ‘public’ company). The rise or fall in the value of this fictitious asset – the shareholder certificate – representing the capitalisation of anticipated income streams can sometimes bear little apparent relation to current movements in the real economy. The secondary market in the buying and selling of these financial assets is essentially driven by market expectations of future profitability, and this can have a speculative element.

That helps to explain the rather puzzling coincidence of a buoyant stock market with share prices sometimes reaching record highs alongside a real economy that shows every sign of being in the doldrums. A different kind of logic applies in each case. ‘Autonomisation’ is the buzzword to describe the tendency for fictitious capital to strive to transcend or unshackle itself from real capital in the business of money making.

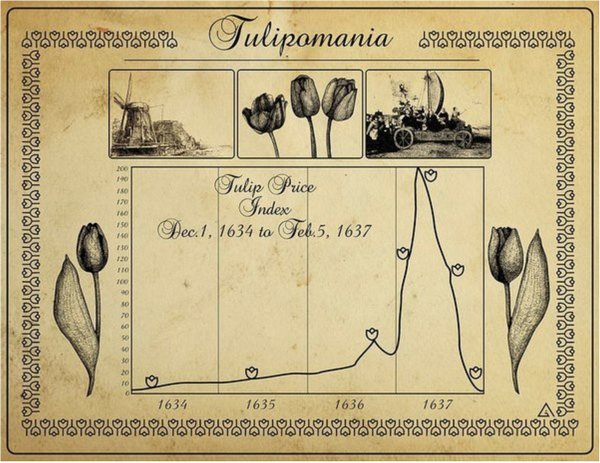

Though ultimately fictitious capital cannot sever itself from developments impacting on real capital, there does, at times, appear to be a certain disconnection between them. Speculative activity that grew out of the very system of credit that financed industrial development can, at times, become frenzied and take the form of speculative bubbles – from the Dutch tulipmania bubble (1634-38) through to the internet-based Dot-Com bubble of the late 1990s, and many more besides. Inevitably these burst at some point when, as Marx noted, the magic of compound interest breaks down as, indeed, it eventually must.

In the meanwhile, as far as these paper claims to future income that constitute fictitious capital are concerned:

‘To the extent that the depreciation or increase in value of this paper is independent of the movement of value of the actual capital that it represents, the wealth of the nation is just as great before as after its depreciation or increase in value’ (Capital, Vol. 3, Ch. 29).

The belief that wealth can be created merely by making money from money is akin to the medieval belief in alchemy – that you can transform base metals into gold.

It is the investment of this ‘real capital’ that generates the surplus value the system fundamentally depends on. This presupposes the employment of wage labour to create the surplus value out of which such capital originates in the first place.

Fictitious capital, on the other hand, does not and cannot create surplus value at all but at best merely redistributes it amongst fractions of the capitalist class.

ROBIN COX

One Reply to “The rise of fictitious capital”

Leave a Reply

You must be logged in to post a comment.

Fascinating!

Fun Fact: Despite being a genius, Isaac Newton believed in alchemy. Apparently, he spent a good chunk of his career attempting to turn base-metals into gold.